Coins Coins Coins.. And Base

Weekend rants

Greetings fellow readers! Hope everyone is having a great weekend!

Sucks that Cypher got exploited but they’re pretty well funded and apparently in contact with the exploiter (or had), so all we can do is just wait for now.

Been pretty active in BASE, spending majority of my time on this chain looking and apeing into coins and projects. Will share some tokens that I’m looking at opening a position or have one already.

First things first: FARMS

Have deployed a large chunk to farm on protocols on Base at the moment, cause yields here are still pretty decent compared to mainnet/other chains.

Baseswap

If you have heard of Arbidex, its from the same team. These are pretty decent APRs at the moment and pretty decent on sizing. Assets like USDC,DAI,CBETH are bridged from mainnet using Base’s official bridge, whereas MIM can be bridged using Abracadabra and AXLUSDC is bridged via Axelar’s bridge.Swapbased

This is from Kell, a dev who forks other protocols and launches his own like Skullswap and Cranium on Fantom, Prisma Finance (GMD fork) which I think failed to raise enough money to even start. However, launching a DEX on Base seemed to work. Although keep in mind his farms have deposit fees for most non-native assets (1%) so do your calculations before apeing.Velocimeter

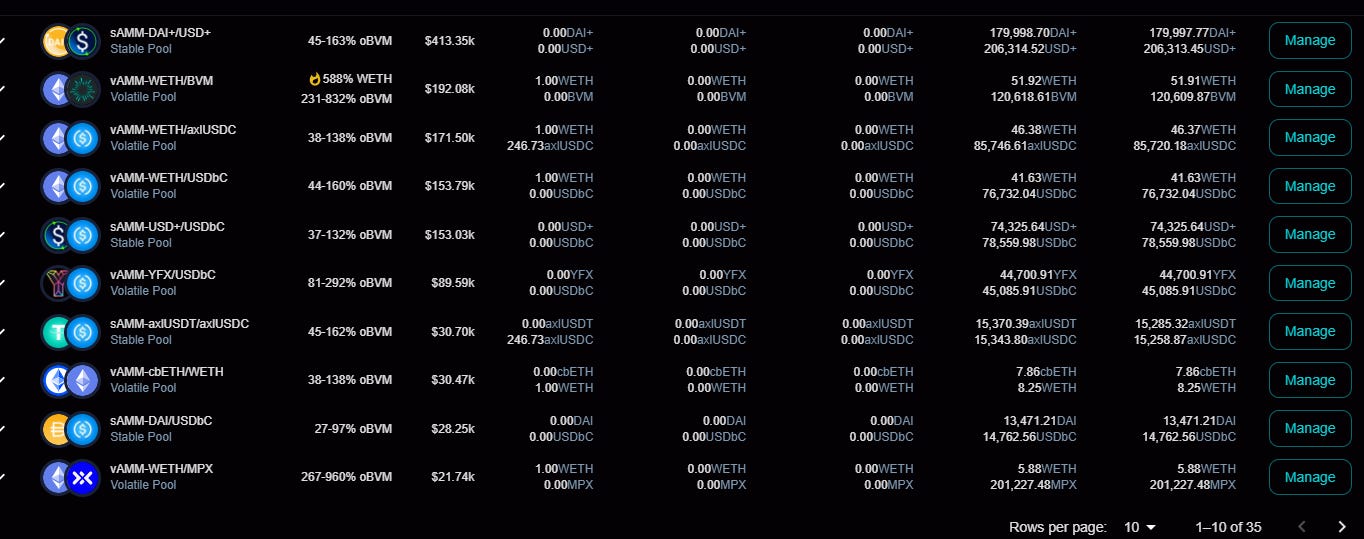

Velocimeter initially was on Canto but expanded to multiple chains. Team is pretty okay and have been running for quite some time, its just another solidly fork but rewards for non-native are mostly paid out in oBVM (options) where if you redeem it to liquid BVM to dump for other assets (USDC/ETH etc.), you pay 75% of the redeemed value in ETH. The APRs shown are mostly A%-B%, where A% is taking into account the 25% discount but I’ve been farming for some time and it doesn’t look as accurate but still worth farming IMO.

At the moment I’m farming in 3 of these protocols, there are other DEXs like Rocketswap, ThroneDex etc but not worth moving money over there to anon teams and farm in their protocols when there are the 3 above which I’m personally more comfortable with.

Notable mention: Moonwell

Initially a money market on Moonbeam/Moonriver, but got screwed heavily with the Wormhole and Nomad hack which caused the pegged assets to essentially go to zero.

They’re live at the moment on Base as 1 of the 2 money markets (other one is called Magnate but it looks sus). Some of the incentives paid are in WELL token which can be swapped/traded on Balancer as their LP pool is the 80/20 LP tokens on there. Looping (if you trust a money market) is pretty decent at the moment, up to 30-50% APR.

Few projects I’m keeping an eye on:

Basin by Forgiving (2omb/3omb dev)

TLDR of project: Similar to LUSD and Liquity (overcollateralized debt product) with Basin as their governance token and BAI as their CDP stablecoin.

They had a 200ETH presale which sold out, and is vested for 7 days linearly starting from August 10th. Currently, beta test for controlled minting of BAI will go live on August 16th-25th, whereas the full launch begins on the 27th of August. Their audits are scheduled to start on the 15th of August and lasts for 10 days.

The fact that beta starts 1 day before the end of linear vesting is pretty decent as we’ve seen presalers panic dump their tokens to oblivion at the moment, lowest it went was $2.30 which was roughly around the public round presale price. Private was a tad lower at around $1.80. Am currently DCA-ing for a short term swing as I’m pretty sure Basin will be an incentive for people to farm/mint BAI but its the only liquid token for the protocol, and there’s no LSD project on Base yet so am swinging this.

Based Markets

Don’t really have much info on this, but apparently is a derivatives style protocol based on DEUS’s SYMM and Lafa tweeted about them.

Product is not live yet, and the token was pretty heavily aped by insiders with extremely large bags. The first 2 whales who bought $4.6k and $17.6k are up A TON. Dev also added single sided liquidity on Uniswap v3 so technically there was 0 ETH added into the LP initially. So be careful and monitor these wallets if you decide to ape, I’m still just looking at it.

Other tokens I am looking at but nothing much to talk about them so just writing them down:

BASO: First solidly fork on Base, farms go live in 4-5 days.

OATH: ThroneDex’s native token, Camelot fork on Base, kinda sus ngl.

Aerodrome should be next week so keep an eye as well.

ps: if you’re looking for farms, always check KyberSwap on different chains, Linea’s just went live and stables paying 30-50%

Other non-BASE tokens I’m looking at or have a position in. I’m no TA guy so I’m just drawing lines on a chart and hope token goes up tbh.

Pepe

Already have a position entered. Been seeing some wallets rotating into Pepe, and ton of people have begun tweeting about it including Kaleo and Zoomer. Feel like people are rotating Unibot/RLB profits and other memecoins into this cycle’s “Doge”. Green coin gud coin kek.

Mantle

0x137AfecE9991a5625Ab1510cf98Eadc937f0B55f dumped around $4 million of the Mantle token ($MNT) on August 8th, sending the price to $0.38. Apparently it was due to several MNT contributor/investor wallets getting hacked, zachxbt tweeted. But ever since then it recovered slightly and has been stationary for pretty much the entire time.

BASE is currently where all the hype is at the moment, there are only a few protocols live on Mantle and none have a liquid token to trade hence no hype (well except Mantle Inu the memecoin lol). Personally think projects are slow because all of them are working on getting grants from Mantle before deploying properly. Think its just a matter of when when projects start launching on Mantle.

If you think about other new chains that are launching, liquidity usually flows over if there are DAPPs and projects launching on it (as we’ve seen BASE’s TVL skyrocket from $10M to over $111M in a matter of days). So the only few “hot” chains on my radar that have yet to be launched is SEI but due to the smart contract language being different (non-EVM), I doubt many protocols / TVL will flow over at least in the beginning, and it’ll likely be like Aptos/Sui. So the only chains money will flow into is either Base or Mantle. So I’m just patiently bagholding my MNT and will wait till DeFi season starts on Mantle.

SHIB/BONE

We’ve seen SHIB pump over the last few weeks due to the announcement of Shibarium launching (their own chain), which if you recall when Dogechain launched, it was literally memecoin madness for like a week, and then it died off. The difference was that Dogechain was spun up by the community whereas Shibarium seems to stem from the actual Shib team.

I expect memecoin mania to be in full-swing mode on Shibarium when it launches, and will bridge SHIB over to gamble, but do not think it is sustainable and will eventually die off as we’ve seen happened to Dogechain. Also fully agree with RunnerXBT’s tweet about his thoughts on Shib. So keep your eyes peeled for the Shibarium announcement supposedly happening around the 15th/16th of August.

That’s it for this edition, and as usual, none of the above is financial advice! Just some weekend writing, feel free to leave comments if you have any questions and would love to hear your thoughts as well!